The Collision of Two Worlds

Global climate action is at a tipping point. On one side, corporate ESG reporting is tightening with frameworks like CSRD (EU), TCFD (global), and SEC climate disclosure mandates (U.S.). On the other, Web3 innovations like carbon tokenization, smart contracts, and decentralized MRV (Monitoring, Reporting, and Verification) are creating programmable transparency. But these two worlds are not yet integrated.

While platforms like Toucan and Puro Earth have pioneered tokenized carbon credits and registry-based engineered removals, they fall short of serving both crypto-native buyers and institutional ESG stakeholders. Most existing solutions either sacrifice compliance for speed or sacrifice transparency for tradition.

What the market needs is a next-generation carbon credit infrastructure — one that is registry-aligned, real-time auditable, ESG-compliant, and cross-border liquid. This is the blueprint for how to build it.

Registry-Compliant Token Bridges: Anchoring Trust at the Source

Today’s biggest credibility gap in Web3 carbon markets stems from tokenizing retired credits without registry alignment. This breaks the chain of custody and opens the door to double-counting.

- Build two-way bridges that interface with leading registries (e.g., Verra, Gold Standard, Puro Earth) via API or verifier-verified document locking.

- Token issuance must be tied to credit serial numbers, methodology ID, and timestamped verification events.

- Retirement must be mirrored: when tokens are retired on-chain, the corresponding credits must be programmatically retired in the registry.

ESG Disclosure Compatibility: Making Every Token Reportable

Corporate buyers are increasingly under pressure to disclose their climate-related activities. However, most tokenized credits lack the fields needed for regulatory disclosures.

Every token must include metadata for:

- Scope relevance: Scope 1 (direct), Scope 2 (energy), Scope 3 (supply chain)

- Carbon type: Removal vs Avoidance

- Permanence window: 10, 50, or 100+ years

- Additionality evidence: e.g., baseline scenario or marginality proof

- Co-benefits: alignment with UN SDGs (e.g., biodiversity, gender equity)

Deliverables:

- Generate CSRD/SEC/SBTi-ready PDFs, CSVs, and dashboard exports

- Include QR codes and IPFS hashes for immutable documentation

Token Architecture: Moving Beyond Fungibility

Carbon credits are not all the same — and the architecture used to tokenize them must reflect that.

- Use ERC-1155 for semi-fungible tokens representing fungible pools (e.g., 2023 biochar from verified suppliers)

- Use ERC-721 for unique tokens (e.g., rewilding credits with photographic proof, or biodiversity-linked removals)

- Token metadata should support nested attributes and backward-compatible upgrades (e.g., new regulations or methodologies)

On-Chain MRV and Immutable Auditability: Trust Through Real-Time Data

Monitoring, Reporting, and Verification (MRV) is the beating heart of any credible credit. Traditionally, it’s a PDF — today it can be a blockchain-synced data stream.

Integrate MRV from:

- IoT sensors: temperature, carbon content, pyrolysis rates

- Drones & AI vision: for afforestation, mangrove, kelp projects

- Satellite data: NDVI, biomass, carbon flux

Smart contracts validate this data, trigger credit issuance, and log the evidence immutably.

Multi-Asset Market Segmentation: Enabling Quality Differentiation

Buyers care about quality, not just tonnes. Yet today’s markets offer undifferentiated carbon pools that obscure value.

Create asset classes and filters:

- Nature-based vs Tech-based

- Durable vs short-term credits

- Registry-verified vs pre-issuance

- Premium (with SDG impact) vs baseline-only

Use dashboards and APIs to allow buyers to build custom ESG portfolios

Fiat and Stablecoin Payment Infrastructure: Borderless and Frictionless

ESG finance doesn’t live on-chain — yet. Most buyers still use bank transfers. Web3-native systems often lack fiat rails.

- Enable stablecoin payments (e.g., USDC, EURC, GUSD)

- Integrate with fiat payment APIs for multi-currency support (e.g., INR, EUR, USD)

- Ensure compliance with AML/CFT/KYC and tax rules (e.g., India’s 1% TDS, U.S. crypto disclosures)

- Include smart receipts with each transaction — including invoice hash, wallet ID, project ID, retirement time.

Legal & Regulatory Interoperability

Trust isn’t just technical — it’s legal.

Build according to:

- India’s FEMA/crypto tax rules

- U.S. SEC disclosure framework

- EU CSRD and MiCA rules for ESG tokens

- Voluntary registry T&Cs

- Use gated tokenization flows (e.g., KYC-only minting) and verify jurisdictional restrictions on buyers/sellers

- Add legal wrappers for tokenized credits as digital receipts, not financial instruments.

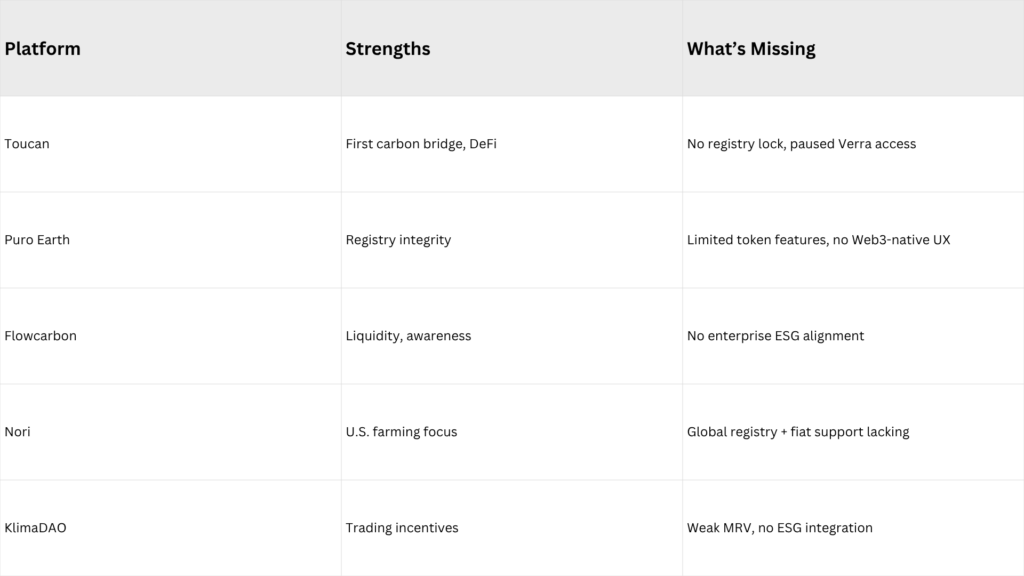

Competitive Landscape Comparison

What to Build

- Registry bridge MVP + biochar onboarding

- Launch stablecoin rails + fiat connectors

- Full ESG metadata framework + export tools

- Dynamic MRV integration + co-benefit indexing

- DAO-lite governance, global expansion, ESG-linked financial instruments

Conclusion: The Infrastructure ESG Markets Need

Building the future of climate finance requires more than platforms — it requires infrastructure:

- Registry-backed tokens

- Real-time, trusted MRV

- ESG-native data architecture

- Cross-border payment access

- Immutable, auditable records

This is the blueprint. Whether you’re a developer, project owner, corporate buyer, or investor — the opportunity is to co-create a programmable, trust-centered, and regulatory-aligned carbon economy.

Let’s make carbon traceable. Let’s make ESG programmable. Let’s build for the planet — and for the future.

WhatsApp

WhatsApp  Book A Meeeting

Book A Meeeting